VALUE ADDED TAX: RIVERS AND LAGOS STATE GOVERNMENTS ENACT LAWS

September 16, 2021

It is no longer news that the Federal High Court in AG Rivers State v. Federal Inland Revenue Service recently held that the competent body to regulate, assess and collect Value Added Tax (VAT), is the State Government.

ADMINISTRATION OF VALUE ADDED TAX (VAT) IN NIGERIA: FEDERAL HIGH COURT DECIDES

It is against the backdrop of this judgement that Rivers State and Lagos State have enacted their respective VAT Laws to regulate the administration of VAT by their relevant Boards of Internal Revenue.

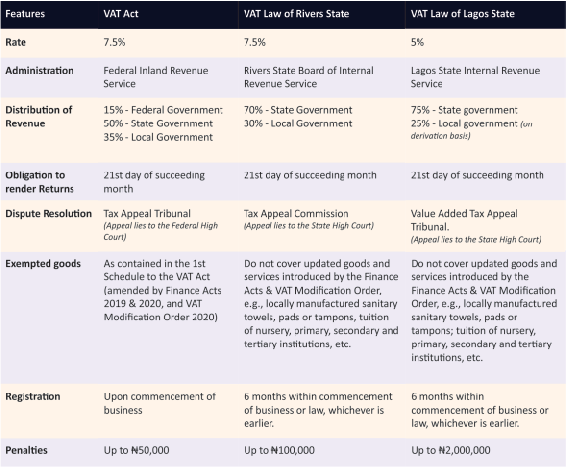

The table below highlights the key features of the VAT Laws in comparison with the extant VAT Act:

OUR COMMENTS

The decision of the Federal High Court in AG Rivers State v. Federal Inland Revenue Service has been a topical issue which has generated several discussions in the past weeks. These discussions have generally hovered around the practicability or otherwise of VAT administration on a state-by-state basis in Nigeria.

There are peculiar challenges which may render the administration of VAT by the States unfeasible, some of which include:

- Input Tax Recoverability: VAT as we know it, is a consumption tax paid on the value added to a taxable item and it is borne by the final consumer. Typically, the input tax incurred at the point of purchase is recovered from the output tax collected at the point of sale. However, with the development, it is unclear how taxpayers who source products or raw materials from one state will recover the input tax suffered in that state from output tax collected on sales of the products in another State, especially with the disparity in VAT rates across the States.

Rather than attempt to administer VAT, States might consider implementing a Goods and Services Tax (GST) regime, as obtainable in some jurisdictions, albeit while aligning the best interests of both the State and taxpayers. This eliminates the issue of input tax claim, as GST will be charged strictly on sales.

- Recent Developments: Finance Acts 2019 & 2020 have ushered in major amendments to the administration of VAT. For instance, companies with a turnover of less than ₦25 million have been excluded from charging and collecting VAT, exclusion of interest in land and building from VAT, expansion of exempted items to include tuition, and so on. These have not been considered by both Rivers and Lagos States as observed from their recently enacted VAT Laws. This creates a setback to the progress already made and imposes additional burden on the taxpayers within the States, especially small companies.

- Import VAT: The States’ VAT laws purport to collect VAT on imported goods as a prerequisite to clearing such goods from the port. It will be recalled that the core of the dispute as averred by Rivers State, is that VAT is not on the Exclusive Legislative List and cannot be administered by the Federal Government. By the same argument, maritime shipping and navigation including ports is listed on the Exclusive Legislative List, thus making it a matter reserved exclusively for the Federal Government. Consequently, VAT on goods brought in through these ports fall out of the purview of the State Governments.

- Consumption Tax: The Supreme Court in AG Lagos v. Eko Hotels Ltd & Anor has held that a State is estopped from concurrently charging both VAT and Consumption Tax. Therefore, States which have an existing Consumption Tax law such as Lagos State, must first repeal such law, where it intends to administer VAT.

- Ease of Doing Business: Due to the complexity the state-run VAT administration portends, Nigeria risks losing foreign direct investment as non-resident companies are required by the States’ VAT Laws to register in all the states where they carry on business. This process is cumbersome and discourages investment, which in turn will affect the country’s ranking on the World Bank Ease of Doing Business Index.

- Penalties: The penalty regime contained in the States’ Laws are steep and punitive in nature. While River State’s VAT Law prescribes a penalty of up to ₦100,000 for failure to register with its Board of Internal Revenue, Lagos State imposes a penalty of up to ₦2,000,000 for aiding and abetting.

On the other hand, decentralizing the VAT administration may lead to introspection on the part of state governments, to harness innate but untapped potentials to build greater capacity for revenue generation and economic development.

For now, we are aware that the Court of Appeal has granted FIRS’ application for a stay of the judgement delivered by the Federal High Court. By implication, Rivers State Government has been ordered to refrain from collecting or otherwise administering VAT on taxable supplies within the State, pending the determination of the appeal of the substantive suit as filed by FIRS.

Taxpayers are however implored to always seek professional advice, especially in the event of uncertainties, to avoid contravention of the law.